All Categories

Featured

Table of Contents

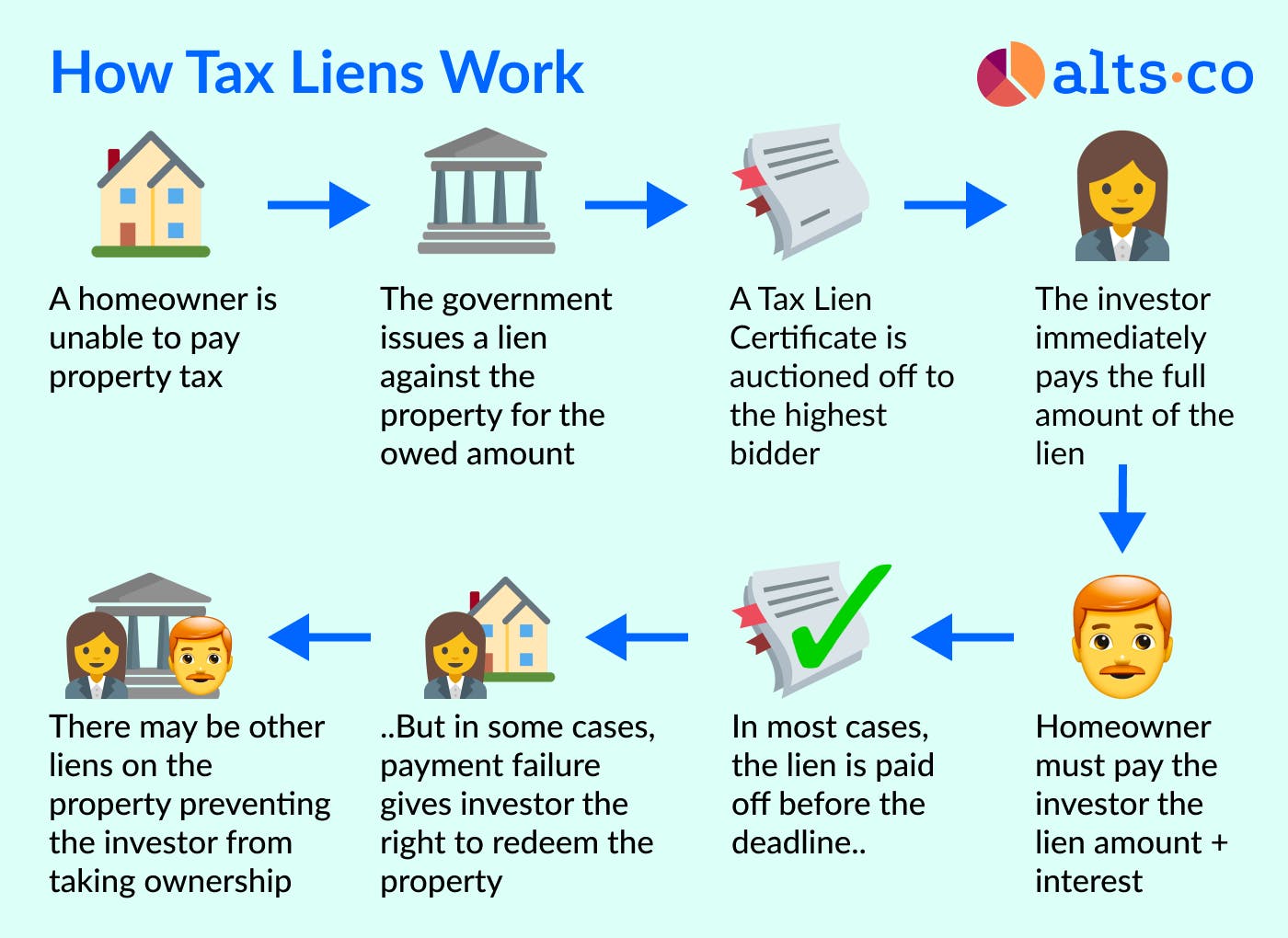

There is a 3 year redemption duration for a lot of homes marketed at the tax obligation lien sale and throughout that time, the home still belongs to the assessed owner. Very couple of residential property tax liens in fact go to act.

The rate of interest rate on tax obligations acquired at the tax lien sale is 9 percentage points over the price cut rate paid to the Federal Get Bank on September 1st. The rate on your certification will continue to be the very same for as lengthy as you hold that certificate. The price of return for certifications offered in 2024 will certainly be fourteen percent.

The certifications will be kept in the treasurer's workplace for safekeeping unless or else instructed. If the tax obligations for following years come to be delinquent, you will be informed around July and provided the chance to back the tax obligations to the certifications that you hold. You will certainly receive the exact same rate of interest on succeeding taxes as on the initial certificate.

You will not be refunded any costs. If the certificate is in your property you will certainly be notified to return it to our workplace. Upon receipt of the certificate, you will get a redemption check. The redemption duration is 3 years from the date of the initial tax sale. You will certainly get a 1099 kind showing the quantity of redemption rate of interest paid to you, and a copy will also be sent out to the IRS.

Spending in tax obligation liens and acts has the possible to be rather lucrative. It is likewise possible to invest in tax liens and acts with much less funding than may be required for other financial investments such as rental residential properties. Thus, this is one of the more popular financial investment selections for owners of Self-Directed IRA LLC and Solo 401(k) programs.

How To Tax Lien Investing

Tax liens might be levied on any kind of kind of home, from raw land to homes to commercial buildings. The regulations surrounding the kind of lien and exactly how such liens are released and redeemed varies by state and by area. There are 2 primary classes, tax obligation liens and tax acts. A tax lien is released right away once they homeowner has fallen short to pay their tax obligations.

Such liens are then marketed to the public. A financier acquisitions the lien, thus offering the community with the necessary tax profits, and after that deserves to the residential property. If the homeowner pays their tax obligations, the investor generally gets rate of interest which can be in the variety of 12-18%.

If the residential or commercial property is not redeemed, the investor may foreclose on the property. Tax liens and actions offer the possibility for charitable roi, potentially with lower quantities of capital. While there are certain danger variables, they are relatively reduced. Tax lien investing is focused on the collection of passion and penalties (where offered) for the tax financial obligation.

The process for spending varies by state and by area. Many liens and deeds are cost auction, with some public auctions occurring in-person at a court, and some taking area online. You will normally require to register in advancement for such auctions and might be needed to put a down payment to get involved.

Tax Lien Investing Online

In some territories, unsold liens or actions may be readily available up for sale "over-the-counter" from the region clerk's office or site after a public auction has actually been completed. Prior to getting involved in an auction, you will wish to do research to determine those homes you may be interested in and guarantee there are no issues such as other liens that may need to be resolved or issues with the residential property itself that may create issues if you were to take control of ownership.

This period is implied to provide the property owner an opportunity to settle their financial debt with the exhausting authority. With a lien, redemption suggests that your IRA or 401(k) will certainly get a cash advance, with interest and any applicable charges being paid.

Tax lien and action investing is a location where checkbook control is a must. You need to be able to release funds straight on short notification, both for a down payment which needs to be registered in the strategy entity name, and if you are the winning prospective buyer. With a Checkbook Individual Retirement Account LLC or Solo 401(k), you can directly make such repayments from your strategy account without hold-ups or 3rd celebration fees.

If you make a down payment and are not successful in bidding process at public auction, the down payment can simply be gone back to the plan account without problem. The several days refining hold-up that includes working straight by means of a self-directed IRA custodian just does not function in this area. When investing in tax obligation liens and deeds, you have to guarantee that all tasks are carried out under the umbrella of your plan.

All costs connected with tax lien investing should come from the plan account straight, as all earnings produced should be deposited to the strategy account. tax lien investing crash course. We are commonly asked if the plan can spend for the account holder to attend a tax lien training class, and recommend versus that. Even if your investing activities will be 100% through your plan and not include any type of personal investing in tax obligation liens, the IRS might consider this self-dealing

Texas Tax Lien Investing

This would certainly likewise be true of getting a property by means of a tax obligation action and after that holding that residential or commercial property as a service. If your technique will certainly entail acquiring residential properties merely to transform about and market those residential or commercial properties with or without rehabilitation that could be deemed a dealership task. If carried out on a normal basis, this would expose the IRA or Solo 401(k) to UBIT.

Just like any investment, there is threat associated with buying tax liens and acts. Financiers should have the financial experience to determine and recognize the dangers, perform the essential persistance, and properly carry out such investments in compliance internal revenue service guidelines. Safeguard Advisors, LLC is not an investment consultant or supplier, and does not advise any kind of details financial investment.

The info above is educational in nature, and is not planned to be, neither must it be understood as providing tax obligation, legal or financial investment advice.

How To Invest In Tax Lien Certificates

Lien imposed on building by regulation to safeguard repayment of tax obligations Pima Area, Arizona delinquent real estate tax listing for auction by the County Treasurer A tax lien is a lien which is imposed upon a residential property by regulation in order to secure the repayment of taxes. A tax lien may be imposed for the purpose of collecting delinquent taxes which are owed on actual home or individual home, or it may be enforced as an outcome of a failure to pay earnings taxes or it might be enforced as a result of a failing to pay various other tax obligations.

Internal Profits Code area 6321 offers: Sec. 6321. LIEN FOR TAX OBLIGATIONS. If anybody liable to pay any tax obligation forgets or refuses to pay the same after demand, the amount (including any type of passion, additional quantity, enhancement to tax, or assessable fine, along with any type of expenses that might accrue on top of that thereto) shall be a lien in favor of the USA upon all property and civil liberties to property, whether genuine or individual, coming from such individual.

Us Tax Liens Investing

Department of the Treasury). Generally, the "individual accountable to pay any tax obligation" described in section 6321 must pay the tax within ten days of the written notice and demand. If the taxpayer falls short to pay the tax within the ten-day period, the tax obligation lien emerges automatically (i.e., by operation of law), and works retroactively to (i.e., occurs at) the day of the analysis, although the ten-day period necessarily runs out after the assessment day.

A government tax lien emerging by legislation as described above stands against the taxpayer without any type of additional activity by the federal government. The general policy is that where two or even more creditors have completing liens against the same building, the financial institution whose lien was refined at the earlier time takes priority over the creditor whose lien was improved at a later time (there are exceptions to this guideline).

Latest Posts

Houses That Need Taxes Paid

Property Tax Lien Investing

Certificate Investment Lien Tax